01

Assessing Risk

Your credit score provides a snapshot of your financial behavior. A higher score suggests you’re less likely to default on payments, while a lower score signals potential risk.

Please fill out the form below

Your credit score plays a critical role in your financial journey, especially when it comes to accessing credit. Whether you’re applying for a loan, financing a vehicle, or seeking a credit card, lenders use your credit score as a key indicator of your financial reliability. But how does this score affect financing decisions, and why is it so important to lenders?

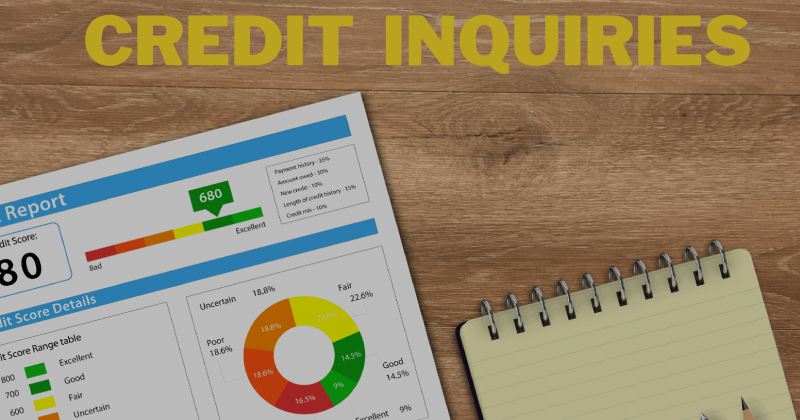

A credit score is a numerical representation of your creditworthiness, based on your credit history. In South Africa, credit scores typically range from 300 to 850 , with higher scores indicating better creditworthiness. Your score is calculated using various factors such as payment history, amounts owed, length of credit history, types of credit, and recent credit inquiries.

Lenders depend on credit scores for several reasons, including:

Your credit score provides a snapshot of your financial behavior. A higher score suggests you’re less likely to default on payments, while a lower score signals potential risk.

Your score reflects how well you’ve managed credit in the past. This helps lenders predict how you’ll handle new credit obligations.

Credit scores make it easier for lenders to quickly evaluate applications. This saves time and ensures a fair, consistent decision-making process.

Lenders use your credit score to determine the interest rates and repayment terms. A higher score often results in lower interest rates, saving you money over time.

Reviewing your credit score and history helps lenders identify any discrepancies that could indicate fraudulent activity.

Your credit score impacts financing in the following ways:

A low score can result in denied credit applications, while a high score increases your chances of approval.

Borrowers with higher scores enjoy lower interest rates, making loans more affordable.

A better credit score may allow you to borrow larger amounts, while a lower score may limit your credit options.

With a poor score, you may be required to pay a larger deposit upfront.

A higher score gives you access to more flexible repayment terms and financial products.

Understanding why your score may be low can help you take action. Here are some common reasons:

Regular late payments negatively impact your score.

Using a large portion of your available credit can signal financial strain.

Applying for multiple loans or credit cards in a short time lowers your score.

A lack of credit accounts or a short credit history may result in a low score.

Applying for multiple loans or credit cards in a short time lowers your score.

Taking steps to improve your credit score can open more doors to favorable financing options. Consider these strategies:

Avoid late payments to maintain a positive payment history.

Keep your credit usage below 30% of your credit limit.

Regularly review your credit report for errors and disputes.

Regularly review your credit report for errors and disputes.

Pay off any overdue accounts to improve your score over time.

A good credit score is more than just a number; it’s a financial asset that helps you:

If your credit score is holding you back, don’t worry—there are ways to improve it and still access credit solutions tailored to your situation. At Refinance-A-Car we specialize in helping clients navigate the complexities of credit and financing.

Contact us today for personalized advice and tools to enhance your credit profile. Let us help you achieve your financial goals!

© 2025 RefinanceaCar. All rights reserved.

32 Mercury street, Eastrand Office Park, Benoni, 1500